Perfectly about 90% of the money in circulation now is already digital, In keeping with Harvard Enterprise Overview (HBR), with rapid declines in the use of income having accelerated due to the pandemic.

In combination with diversifying resources of world liquidity and assisting to balance trade flows, stablecoins could also Enhance economical inclusion by minimizing the global very poor’s dependence on Bodily income. One particular-in-a few Grown ups throughout the world does not have a bank account, almost all of whom live to tell the tale a number of dollars each day and do not satisfy least account balance specifications. This problem is compounded because of the confined reach of Bodily banking infrastructure around the world.

Digital currencies are poised to have an impact over the financial system; about 86% of central financial institutions are Checking out the advantages and disadvantages of central bank digital currency.

Final-mile issues for money inclusion: Financial inclusion will go on for being an issue for nations or communities that cannot manage the digital gadgets needed to maintain digital currencies or do not need entry to basic infrastructures for instance electrical power, internet, identification expert services or shops to convert money into digital formats.

Create a no cost account and accessibility your personalised content material collection with our most up-to-date publications and analyses.

This fragmentation could one day threaten The steadiness of the wider financial program – plus some rising industry and producing economies are previously remaining “materially afflicted” from the substitution of currency for copyright property, in accordance with the Intercontinental Financial Fund (IMF).

Providing persons use of monetary solutions is observed as vital to achieving the UN’s Sustainable Progress Ambitions. CBDCs could transform fiscal inclusion as they may be made use of directly by using a mobile phone, most likely benefitting the in excess of 600 million individuals world wide who may have usage of a cell although not to the banking account.

Stablecoins could increase the access of purchaser and compact business credit rating across borders by lowering exposure to foreign Trade possibility as well as the high fees associated with Intercontinental payment networks.

Having said that, interoperability may come in the expense of amplified publicity to failures or breaches plus a slower rate of innovation as vendors conform to widespread details and software specifications.

The united states’s central lender, the Federal Reserve, suggests that if it released a CBDC, It will be “the safest digital asset accessible to most of the people, without any related credit history or liquidity danger”.

The Redesigning Rely on with Blockchain in the availability Chain initiative is helping provide chain selection-makers employ blockchain, though making certain that this know-how is used in the protected, dependable and inclusive way.

Financial and Monetary Programs What exactly are central bank digital آموزش ارز دیجیتال در مشهد currencies and what could they signify for the normal person?

“About another four decades, we should always hope to find out lots of central banks make a decision whether or not they will use blockchain and distributed ledger systems to enhance their procedures and economic welfare.

To obtain the complete probable of digital currencies, it will be crucial for nations around the world to indicator new types of trade agreements to empower market place access for personal issuers of digital currencies, to allow payments to operate along with each other, and to allow information to flow freely and with belief.

Amanda Bynes Then & Now!

Amanda Bynes Then & Now! Bradley Pierce Then & Now!

Bradley Pierce Then & Now! Michael C. Maronna Then & Now!

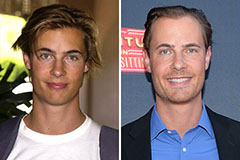

Michael C. Maronna Then & Now! Erik von Detten Then & Now!

Erik von Detten Then & Now! Raquel Welch Then & Now!

Raquel Welch Then & Now!